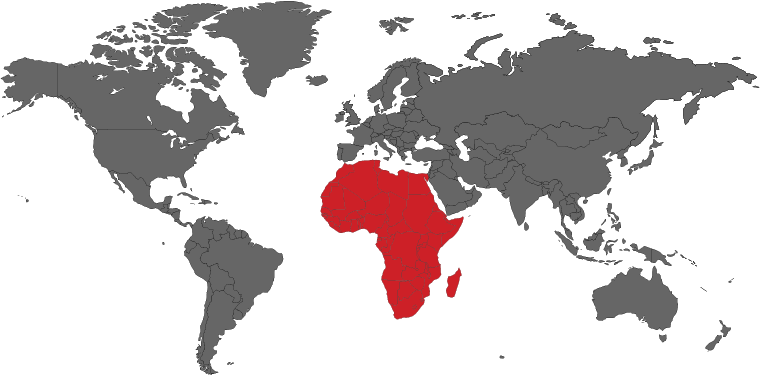

Bridging Nations, Empowering Trade: Logistics for a Rising Africa

Importing and Exporting to Africa: Your Complete Guide

Unlocking Opportunities in African Trade

Africa is a dynamic and diverse continent with immense opportunities for both imports and exports. From thriving markets like Nigeria, South Africa, and Kenya to emerging economies across the continent, understanding the region’s trade regulations, customs processes, and logistics challenges can help businesses succeed in this rapidly growing market.

Key Considerations for Importing and Exporting to Africa

1. Customs Regulations & Compliance

African nations each have their own customs regulations, but some common frameworks and organizations are essential for understanding the import-export landscape.

- African Continental Free Trade Area (AfCFTA): This continental agreement seeks to create a single continental market for goods and services, facilitating smoother trade between African nations by reducing tariffs and non-tariff barriers.

- Customs Authorities:

- South Africa: Managed by the South African Revenue Service (SARS), customs regulations are tightly enforced, especially for sensitive goods like pharmaceuticals, electronics, and food.

- Nigeria: Overseen by the Nigerian Customs Service (NCS), Nigeria requires strict compliance with import duties and regulations for different sectors.

- Kenya: The Kenya Revenue Authority (KRA) handles customs in Kenya, and imports are subject to comprehensive rules, particularly in agriculture and manufactured goods.

2. Tariffs, Duties, and Taxes

Tariffs and duties vary depending on the country, product category, and trade agreements. Key points to keep in mind:

- AfCFTA Benefits: Countries that are part of the AfCFTA offer lower tariffs for intra-Africa trade, which reduces barriers for businesses importing and exporting within the continent.

- Import Duties: Many African countries apply high import duties to protect local industries. However, regional trade agreements like the Economic Community of West African States (ECOWAS) can reduce the impact of tariffs for certain member states.

- Value-Added Tax (VAT): Most African nations apply VAT or sales tax on imports. The VAT rate can vary significantly from country to country.

3. Documentation Requirements

Import and export activities to Africa require a variety of documentation to ensure smooth customs clearance:

- Commercial Invoice

- Bill of Lading or Airway Bill

- Certificate of Origin (especially for countries benefiting from preferential trade agreements)

- Import/Export Declaration Forms

- Phytosanitary and Veterinary Certificates (for agricultural and food exports)

- Product Certification or Conformity Assessments (required for products like electronics and pharmaceuticals).

4. Product Standards & Certifications

Product standards and certifications vary widely across Africa:

- South Africa: Governed by the South African Bureau of Standards (SABS), which ensures products meet safety and quality standards, particularly in the automotive, food, and electronics sectors.

- Nigeria: The Standards Organization of Nigeria (SON) sets mandatory product quality standards, especially for electronics, chemicals, and food products.

- Kenya: Kenya Bureau of Standards (KEBS) enforces stringent rules on food products, building materials, and consumer goods.

5. Logistics & Transportation

Africa’s vast size and infrastructure challenges require strategic logistics planning:

- Port & Freight Infrastructure: Major ports like Durban (South Africa), Mombasa (Kenya), and Lagos (Nigeria) are key entry points for goods into Africa. Understanding local shipping routes and port capacities will help optimize transportation costs.

- Road and Rail Transport: In countries with less-developed infrastructure, road transport is the primary method for moving goods. Rail services are also vital in countries like South Africa, Kenya, and Egypt.

- Air Freight: Air cargo is a popular method for high-value goods but may incur higher costs compared to ocean freight.

6. Currency & Payment Systems

Currency volatility and different payment systems in African countries can complicate transactions.

- Currency Considerations: Many African countries have their own currencies (e.g., South African Rand, Nigerian Naira, Kenyan Shilling). Exchange rate fluctuations can affect the cost of imports and exports.

- Payment Systems: International payments may be subject to government controls or restrictions. Letters of credit (LCs) or trade financing may be required to secure payments.

7. Common Challenges & Solutions

- Regulatory Complexity: The regulatory landscape can be complex, with frequent changes. Partnering with local customs brokers or consultants can help you stay updated and compliant.

- Infrastructure Gaps: Poor infrastructure in some regions can cause delays and increase transportation costs. Working with reliable freight forwarders with local expertise can mitigate these issues.

- Corruption and Bureaucracy: Transparency and administrative processes may vary. It’s crucial to build strong relationships with trusted local partners and agencies to navigate any bureaucratic hurdles.

Start Your Import-Export Journey in Africa with Confidence

Africa is a continent full of growth potential, offering opportunities for trade in various industries such as agriculture, energy, technology, and manufacturing. By understanding the continent’s customs processes, trade agreements, and regulations, businesses can leverage this emerging market for success.

Partner with experienced logistics, customs, and trade professionals to ensure smooth and compliant import and export operations.