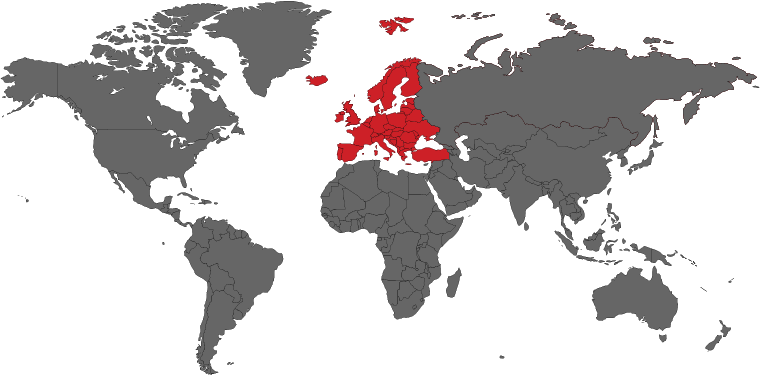

From Ports to Markets: Fast & Secure Freight Across the Europe

Importing and Exporting to Europe: A Complete Guide

Navigating European Trade: Opportunities and Challenges

Europe is one of the world’s largest trading regions, offering access to a diverse and highly competitive market. Whether you’re looking to import goods into the European Union (EU) or expand your business by exporting European products, understanding the regulatory landscape and logistics can help ensure smooth operations and compliance across the continent.

Key Considerations for Importing and Exporting to Europe

1. Customs Regulations & Compliance

European customs regulations are governed by a unified framework for EU member states, with some differences in non-EU countries.

- European Union Customs Union: The EU operates as a single customs territory, meaning that goods moving between EU countries are not subject to customs duties or controls. However, goods entering the EU from non-EU countries are subject to customs procedures and import duties.

- Non-EU Countries: Countries like Norway, Switzerland, and the UK (post-Brexit) have separate customs regulations that businesses must comply with when importing or exporting goods.

2. Import Duties, Tariffs, and VAT

- Import Duties and Tariffs: The EU applies common external tariffs on imports from non-EU countries. The tariff rates depend on the type of product and its classification under the Harmonized System (HS) Code.

- Value-Added Tax (VAT): The EU imposes VAT on most imported goods. VAT rates vary by country, with the EU having a minimum standard rate (usually around 15-25%). When exporting to the EU, VAT is typically exempt or deferred until goods enter the final market.

- Customs Declarations: Importers are required to submit customs declarations, including information about the product’s origin, value, classification, and purpose.

3. Documentation Requirements

The correct documentation is crucial for smooth customs clearance and compliance in European trade:

- Commercial Invoice

- Bill of Lading or Airway Bill

- Certificate of Origin (particularly for products from preferential trade partners)

- Customs Declaration Form (SAD – Single Administrative Document)

- Import/Export Licenses (for specific goods like pharmaceuticals, chemicals, or agricultural products)

- Conformity Assessments and CE Marking (required for certain products like electronics, machinery, and medical devices)

4. Product Standards & Compliance

Europe has strict product standards to ensure consumer safety, environmental protection, and fair competition:

- CE Marking: Certain products like electronics, toys, medical devices, and construction products must bear the CE mark, indicating they comply with EU standards.

- Health and Safety Standards: The EU enforces rigorous regulations for food, cosmetics, chemicals, and pharmaceuticals. The European Food Safety Authority (EFSA) and the European Medicines Agency (EMA) oversee these sectors.

- Eco-Labeling and Sustainability: The EU is committed to environmental sustainability, so products must meet environmental standards such as REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances).

5. Logistics & Transportation

Europe boasts a highly developed infrastructure, but businesses must plan logistics carefully to ensure efficient transport:

- Ports and Airports: Major entry points for goods include ports like Rotterdam (Netherlands), Hamburg (Germany), and Antwerp (Belgium), as well as airports in Frankfurt, Paris, and London.

- Land Transport: With an extensive road and rail network, land transport is a popular option for intra-European trade, especially between neighboring countries.

- Shipping and Freight: Europe’s well-established maritime and air freight systems make it possible to import and export goods quickly and efficiently, though choosing the right mode of transport can impact cost and delivery speed.

6. Currency & Payment Systems

The Euro (€) is the common currency across most of the EU, but some countries (e.g., the UK, Switzerland) still use their own currencies. Understanding currency exchange and payment systems is essential:

- Payment Terms: Letter of Credit (LC), advance payment, or open account are common payment methods for European transactions.

- Currency Risks: Fluctuations in currency exchange rates can impact the cost of imports and exports, especially when trading with non-Euro countries.

- Customs Payments: Import duties and VAT are typically paid upon goods’ arrival in the EU, with payment methods varying depending on the country.

7. Free Trade Agreements & Trade Preferences

The EU has established free trade agreements (FTAs) with various countries and regions worldwide, offering reduced or zero tariffs on goods that meet the origin requirements:

- EU Free Trade Agreements: The EU has FTAs with countries in Europe, North America, Africa, Asia, and Latin America. These agreements facilitate easier access to the EU market and often reduce tariffs on qualifying products.

- GSP (Generalized Scheme of Preferences): The EU offers preferential tariff treatment to developing countries under the GSP, encouraging trade and economic growth.

8. Common Challenges & How to Overcome Them

- Customs Delays: Customs processing can be slow, particularly in high-traffic ports. Ensuring accurate and complete documentation can reduce delays.

- Regulatory Complexity: Different EU member states may have slight variations in implementation, especially regarding VAT, product standards, and environmental regulations. Work with a customs broker or trade consultant to stay compliant.

- Supply Chain Disruptions: The European market is highly integrated, but logistical disruptions (e.g., port congestion, strikes, or border delays) can impact trade. Effective risk management and contingency planning can mitigate these issues.

Start Your Import-Export Journey to Europe with Confidence

Europe offers vast opportunities for businesses engaged in both importing and exporting. With a unified customs system, advanced infrastructure, and access to a massive consumer base, Europe remains a top destination for international trade.

Partnering with experienced logistics providers, customs brokers, and trade consultants will help you navigate the complexities of European trade regulations, ensuring timely and compliant transactions.